wealthfront vs betterment tax loss harvesting

Ready to Get Started Today. Ad Automated And Sophisticated Investment Strategies To Optimize Performance At A Low Cost.

Wealthfront Vs Betterment Wealthfront

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

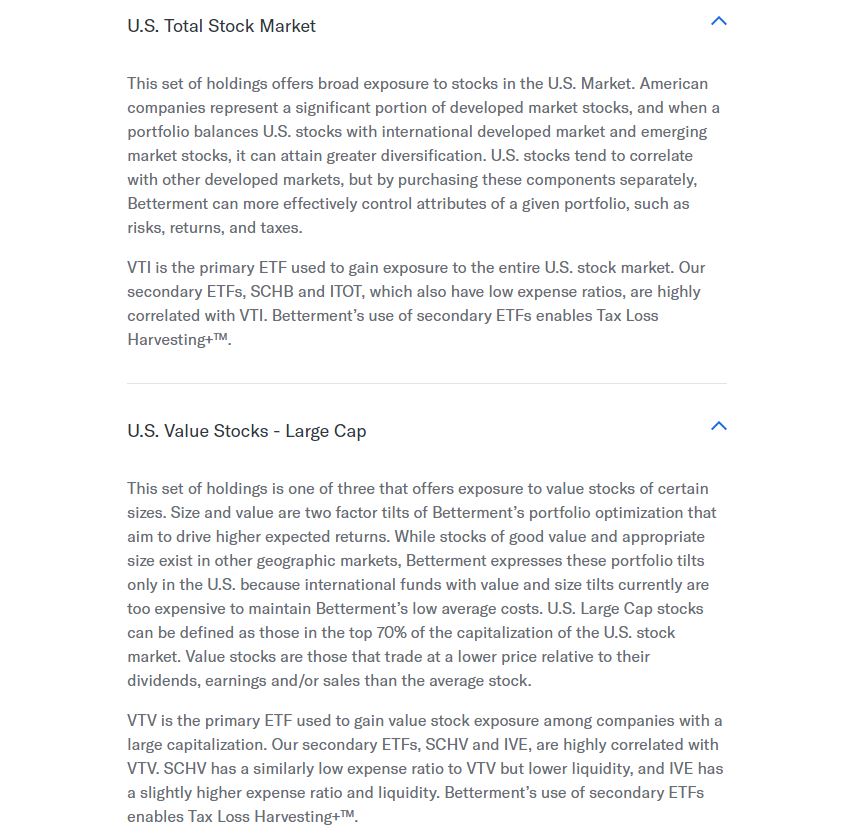

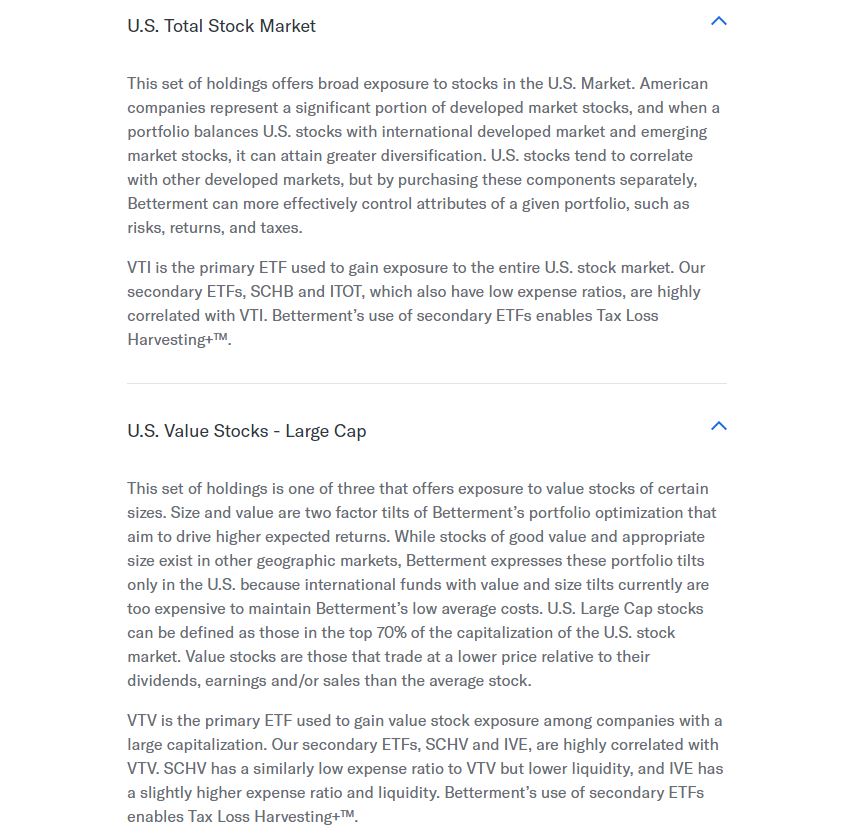

. Find a financial advisor or investment pro who has your best interest in mind. Its like regular tax-loss harvesting but instead of investing in only ETFs or index funds it invests in individual stocks in the SP 500. They both offer tax loss harvesting.

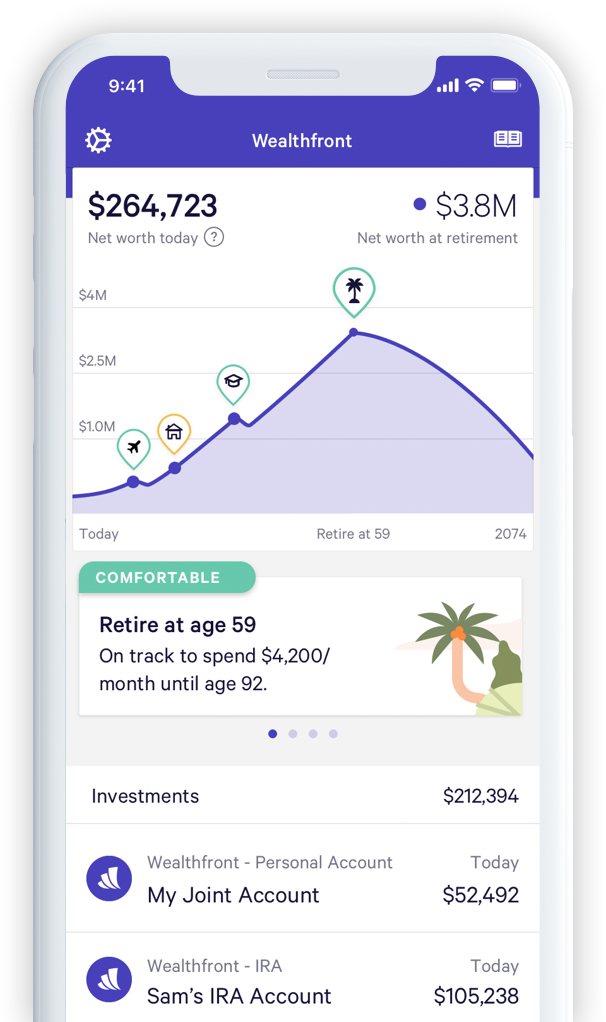

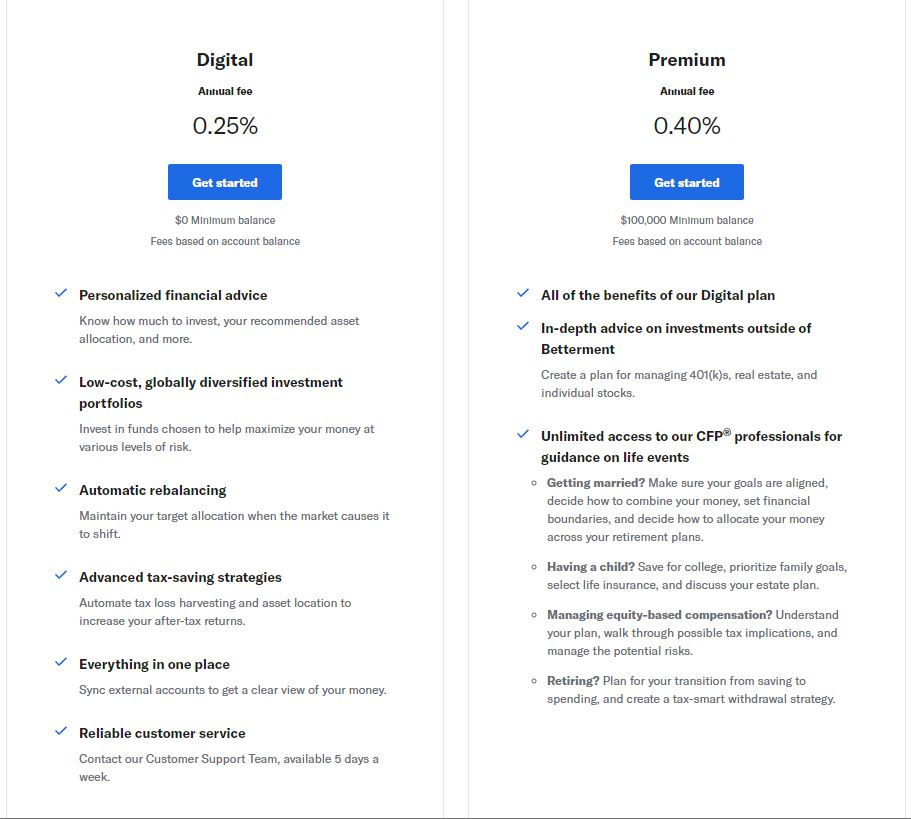

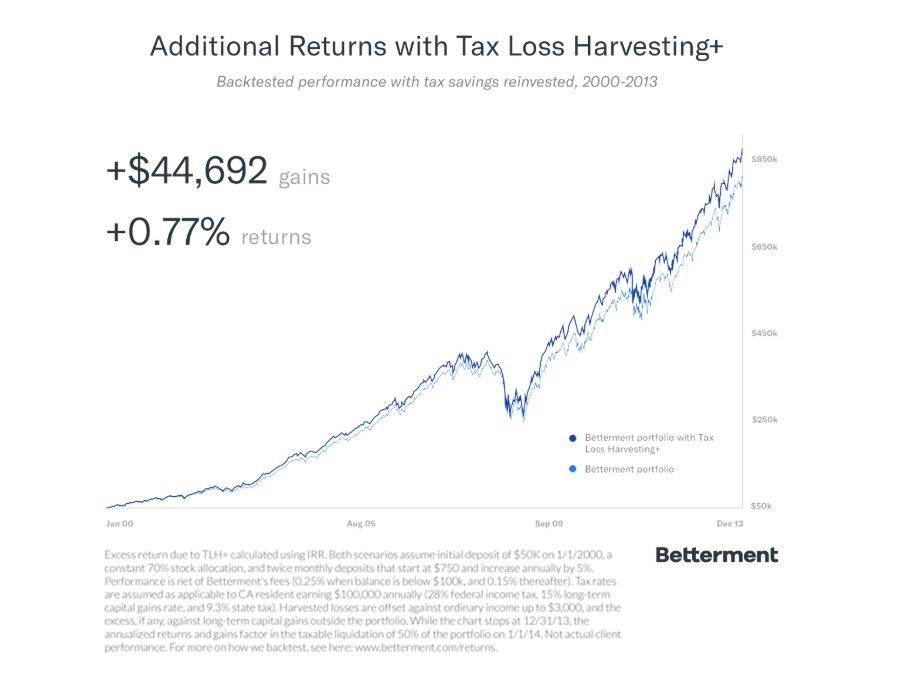

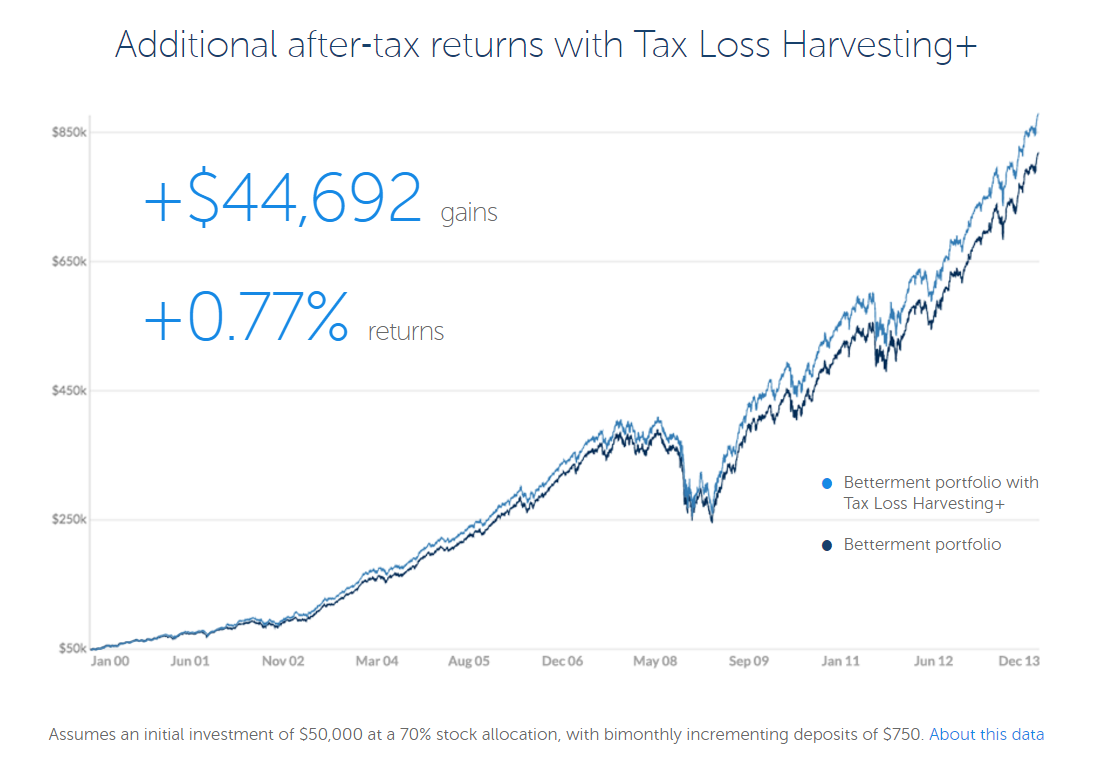

Betterment and Wealthfront both use daily tax-loss harvesting to try to maximize your gains. Betterment and Wealthfront both charge an annual fee of 025 for digital portfolio management. Our Financial Advisors Offer a Wealth of Knowledge.

If I look at the value prop for Betterment or Wealthfront it seems that I can achieve all of the benefits of their service through Vanguard using Admiral Total Market funds except for tax. Searching for Financial Security. Typically theyll sell one fund and then replace it with another that has many similar.

Open An Account In As Little As 10 Minutes. The stock-level tax-loss harvesting and risk parity strategies require a minimum account balance of 100000. Tax loss harvesting is an advanced investment strategy that Wealthfront and Betterment have both brought to consumers at no.

Open An Account In As Little As 10 Minutes. Ad Great Service Should Not Be A Tradeoff. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Wealthfront avails tax loss Harvesting using your losses to offset taxes that would be levied on your gains to everyone using their platform providing benefits to all users alike. TurboTax customers can easily import tax-loss harvesting data from. No crooks - no hidden fees.

Accounts on Wealthfront are charged a flat-rate fee of 025. Tax-Loss Harvesting is a strategy that takes advantage of movements in the markets to capture investment losses which can reduce your tax bill leaving. Betterment at a glance.

Ad Discover Investment Options that Align with Your Goals. According to the company 96 of customers will have that fee covered by tax savings. Grow Your Long-Term Wealth Effortlessly At A Low Cost.

If you have the cash Wealthfront has a definite. PFI SmartAssetLike Betterment Wealthfront also offers. Get A Full-Service Experience Without the Full-Service Price.

Unlike Betterment Wealthfront uses stock-level tax-loss harvesting to invest directly in the SP 500 and not just ETFs. Ready to Get Started Today. Ad SmartVestor Pros have been carefully vetted.

Get A Full-Service Experience Without the Full-Service Price. Ad Great Service Should Not Be A Tradeoff. Learn More About American Funds Objective-Based Approach to Investing.

Contact a Financial Advisor.

Sigfig Vs Betterment Which Is Best For You

Betterment Vs Wealthfront The Simple Dollar

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Vs Acorns 2022 Best Platform

Betterment Vs Wealthfront Which Robo Advisor Is Best For You

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Guide Which Is Right For You Minafi

The 13 Best Robo Advisors For 2022 Pros Cons Top Picks Investinganswers

/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Betterment Vs Wealthfront Which Is Best For You

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Acorns Which Robo Advisor Is Best

Top 5 Tax Loss Harvesting Tips Physician On Fire

Betterment Review Safe Robo Advisor For Beginners

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Vs M1 Finance Comparison

Betterment Vs Wealthfront Vs Personal Capital Who S The Best The Republic Monitor